To help you out, we’ve put together a handy guide to explain the role of a solicitor and the process of conveyancing.

If you’re at the very start of your homebuying journey, you might want to start with our guide for first-time buyers.

What is conveyancing?

Conveyancing is the legal process of transferring home ownership from the current owner or homebuilder to the new buyer.

You’ll probably want to hire a conveyancing solicitor as soon as you decide to buy a property. This will help speed things along later as there will be some introductory paperwork to take care of when you first hire a solicitor.

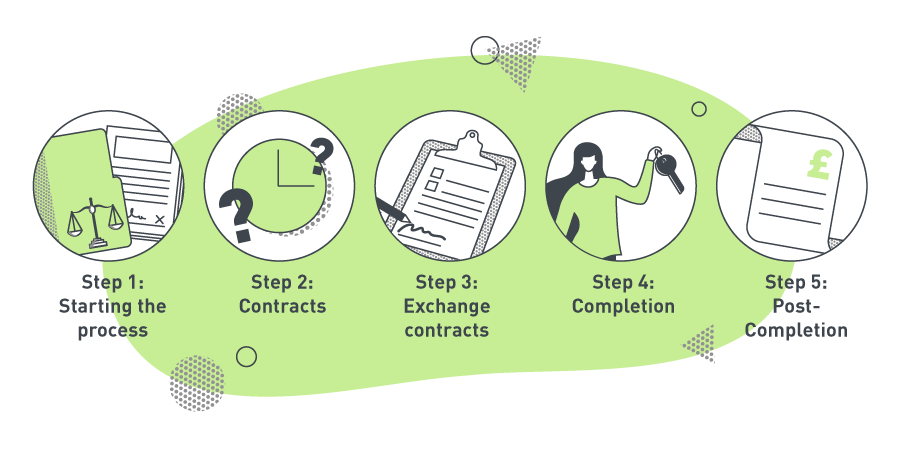

Let’s break down the conveyancing process a little further.

Starting the process

The conveyancing process starts after you’ve made an offer on a house and it’s accepted.

The seller’s solicitor will send a ‘contract pack’, including:

- A property information form

- A draft contract

- Other important documents

Your solicitor will review each of the documents before sending to you. If you or your solicitor have any questions, they’ll be raised with the seller’s solicitor.

At this stage, you’ll need to apply for your mortgage, if you haven’t already. This is a crucial part of the process and, if you want to learn a little more about how mortgages work, you can read a more detailed article here.

A written offer will then be sent from your lender to your solicitor to confirm that funds have been approved. You’ll also sign a mortgage deed – a legal document that outlines the terms of your mortgage and protects your lender in the event you cannot pay back what you borrowed.

Learn more about essential house purchase documents

Property surveys

A property survey is a key part of the conveyancing process as the results will help you understand more about the property you are buying. There are three main surveys that can happen when you’re buying a home:

1. The Valuation Property Survey

Your mortgage lender will organise a valuation survey to confirm the value of the property before committing to lending you the money. If the valuation matches up, the process can proceed.

The valuation survey won’t tell you if there are any problems with the home you want to purchase. You’ll need to arrange your own independent survey for this.

2. RICS Home Buyer Report (HBR)

If the property seems to be in good condition, you may feel that this type of survey is adequate for your needs.

It’s more detailed than the RICS Home Condition Report, letting you know of any structural issues and will cost around £400. It will also give you additional advice on defects and repairs, if needed. You can decide whether you want a survey or a survey and valuation with this type of report.

3. RICS Building Survey

If you’re buying an older or large property, the most detailed of all the reports might be the best option for you.

Depending on the size and value of the property it can cost from £500 to £1000+ for this type of survey. It will give you an in-depth analysis of the home’s condition and structure, highlighting any defects or issues that need addressing.

You can find out more about the different reports in our guide to independent house surveys.

Property searches

To build up a bigger picture, your solicitor also gathers further information at this stage with searches. This includes a local authority search, an environmental search and a water and drainage search.

The local authority search will show if there are any restrictions relating to the land or property, any planning decisions that could affect it and if there have been any planning permission breaches.

The environmental search report will reveal if the land is contaminated, was formally a landfill site or has any stability issues, with the water and drainage search highlighting if there are any public drains on the land.

You may also need extra searches depending on the area – for more on this, you can visit the Government website here. Your solicitor will then send a report of their findings to both you and the mortgage lender, along with the contract to be signed. If you have any questions, let your solicitor know.

Exchange and completion

These are the final two phases: ‘exchange’ and ‘completion’.

What’s does ‘Exchanging Contracts’ mean?

Once your solicitor is happy with the searches and survey findings, a completion date will be agreed with the seller’s solicitor. If things run to plan, contracts will be exchanged, and the exchange deposit will be paid – which means you’re legally bound to buy – with completion usually happening between two and four weeks later once the transfer of property has been arranged.

The exchange deposit is typically 10% of the purchase price. Your solicitor will send a certificate to the mortgage lender, confirming the completion date and applying for release of the funds. Find out more about the buying process in our homebuying guides.

What does ‘Completion’ mean?

On the day of completion, the mortgage lender will transfer your mortgage funds to your solicitor. You will need to transfer the balance of your mortgage deposit to your solicitor, and then they will transfer both funds to the seller’s solicitor, paying for the property in full.

Once this happens, you officially ‘complete’ and you’ll get the keys to your new home.

Post-Completion

After you’ve completed, it’s worth checking in with your solicitor to ensure that the following tasks have been completed:

- Stamp Duty Land Tax – any Stamp Duty required to be paid will be sent by your solicitor to the Inland Revenue, along with a Land Transaction Return. You’ll then receive a certificate of registration from the Land Registry. For more information on Stamp Duty, click here.

- Activation of indemnity policies

- Leasehold property post-completion notices – these are only applicable if the property purchased is leasehold and ensures that the landlord has the new homeowner’s details.

- Registration – the conveyancer will send an application to the Land Registry so the home’s title can be adjusted.

- Receipt of the registered title – this happens once the Land Registry application is approved

If you’re unsure about how the legal side of buying a new home works, make sure you ask plenty of questions and request a clear conveyancing process step-by-step guide from your solicitor.

The Conveyancing Timeline

Every purchase is unique, but here’s a guide to how long the legal process might take:

Pre-contract workOnce you hire a solicitor and make an offer, they will begin:

|

2 weeks |

Arranging a mortgage

|

4 weeks |

Your conveyancing solicitor will start drafting the contractThey will also be:

|

2-10 weeks |

| Time between exchanging contracts and completion | 1-2 weeks |

| Total time from an offer being accepted to completion | 12-16 weeks |