The Help to Buy statistics for the last quarter have been released, showing that the Help to Buy Equity Loan continues to be an extremely popular scheme.

Help to Buy allows homebuyers to buy a brand new home up to the value of £600,000 with just a five per cent deposit, thanks to a 20 per cent loan from the government. Homebuyers can then gain access to much more affordable lending rates with a 75 per cent loan to value mortgage. The loan is interest free for five years and can be paid back after 25 years or when the property is sold, whichever comes sooner.

Between October and December 2017, 13,937 homeowners took advantage of the government initiative, a 14% increase on the same period in 2016.

The figures, released 26 April by the Ministry for Housing, Communities and Local Government (MHCLG), show that almost 160,000 equity loans have been approved since the scheme started in April 2013. Of these, over 80% have been to first time buyers, helping 128,000 people onto the housing ladder for the first time.

Use our interactive map to see a quick overview of how each region fared this quarter.

Commenting on the Help to Buy figures for this quarter, David Thomas, chief executive of Barratt Developments plc, said:

“The new figures demonstrate just how successful Help to Buy is, and how it is helping make home ownership more affordable. Whilst it is also available for second steppers, more than 80% of people using Help to Buy are first time buyers, with almost 130,000 people taking their first steps on the property ladder and moving into their own brand new home.”

The key findings from the latest data release are:

- Since the start of the scheme there have been 158,883 Help to Buy Equity Loans.

- 81% of loans have been to first time buyers – that’s 128,319 households.

- There were 13,937 loans in the 4th quarter of 2017, 11,349 of which were to people buying their first home.

- The average (mean) purchase price of a property bought using a Help to Buy Equity Loan is £283,397 and the average (mean) equity loan is £62,726

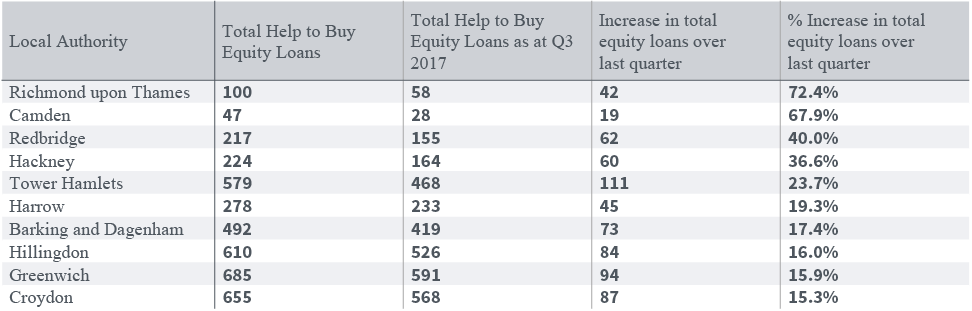

- Since February 2016, when the new 40% equity loan was introduced in London, 6,867 people have used the scheme in the capital, with 5,546 using a loan higher than 20%, and a mean purchase price of £453,457.

- 75% of purchasers have a combined household income of £60,000pa or less – 60% have income of £50,000pa or less.

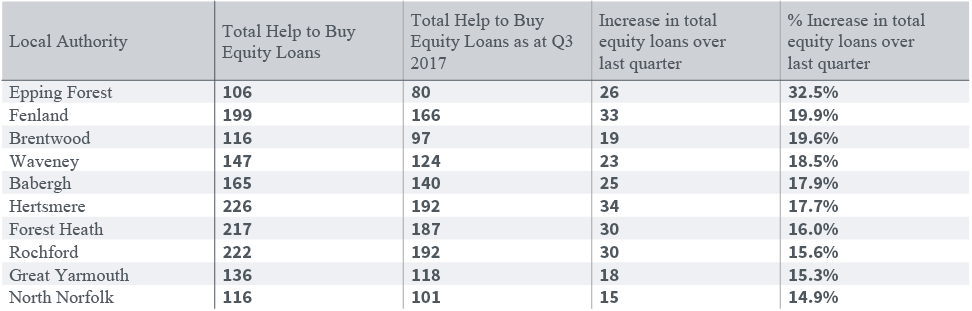

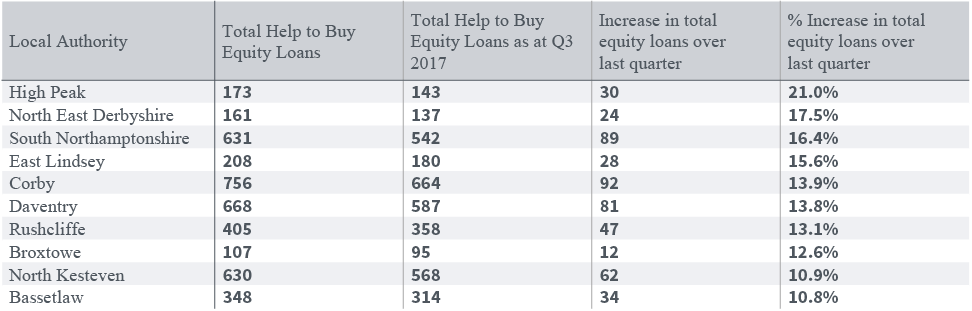

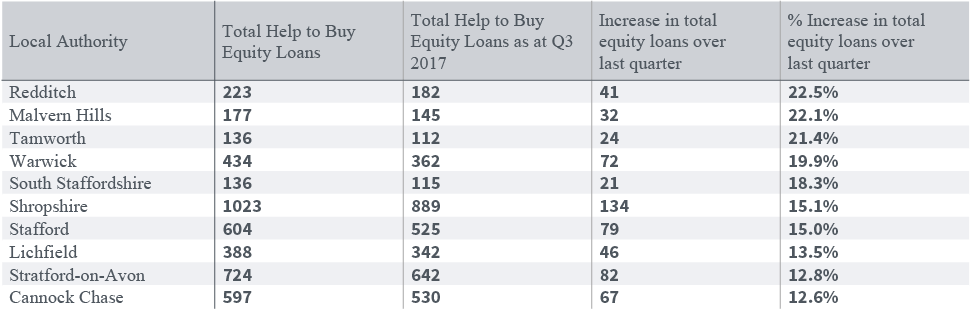

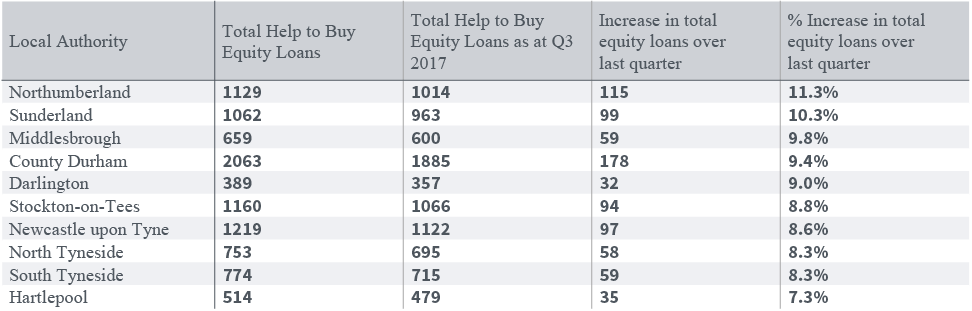

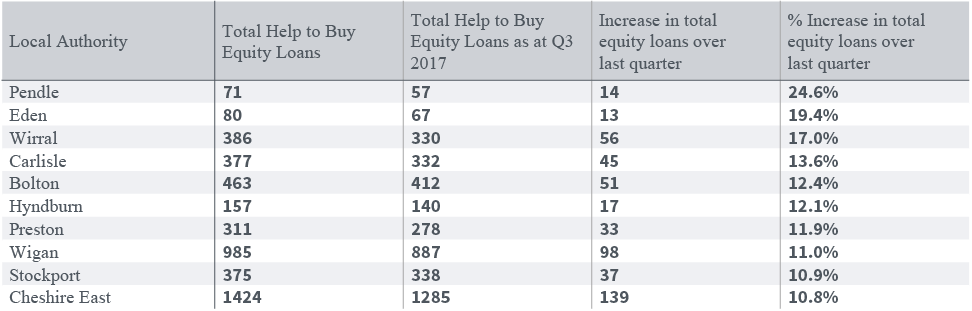

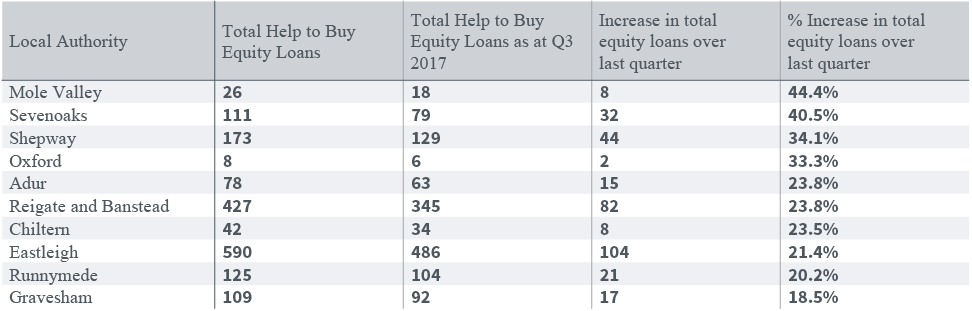

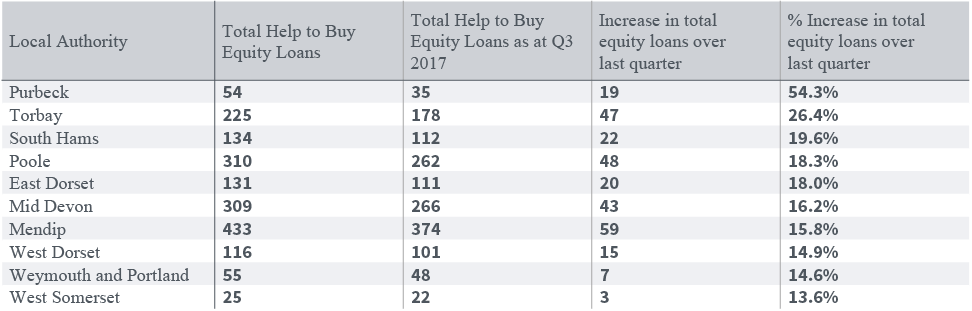

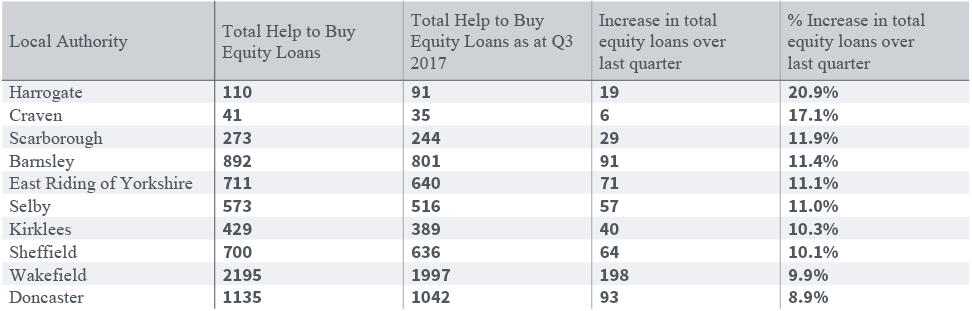

See the 10 Local Authorities in each region of England that had biggest increase in Help to Buy equity loans below.

East of England

East Midlands

West Midlands

London

North East

North West

South East

South West

Yorkshire & Humber

You can see more Help to Buy Q4 data from the Gov.uk website.

For more information on the Help to Buy scheme, please visit the Barratt Homes Help to Buy page.